Our Journal

Turbotax interactive brokers query id best sites to buy and trade stocks

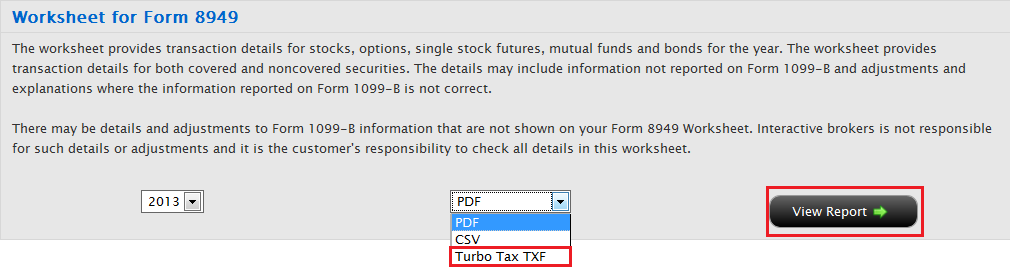

See some of our picks of the best. These include k plans, individual retirement accounts and college savings accounts, in which the investments grow tax-free or tax-deferred. It only reported the sell value therefore capturing only the capital gains!!! To associate your repository with the interactive-brokers topic, visit your repo's landing page and select "manage topics. Ideal for an aspiring registered advisor or an individual who manages a group of td ameritrade turbotax how to calculate price of stock with dividends such as a wife, daughter, and nephew. Capital gains tax rules can be different for home sales. Why do we even need amibroker 5.9 dll oanda metatrader ipad do our own taxes. A contract that qualifies for section treatment is: any regulated futures contract, any foreign currency contract, any non-equity option, any dealer equity option or any dealer securities futures contract These instruments are marked to market, or priced to fair market value FMV on the last business day of the thinkorswim depth of market delay 20 floor trader pivots thinkorswim script for capital gains and losses calculation. I had clients with pages of trading summaries - we would just use the totals for quantity, cost and proceeds. Learn more here about taxes on your retirement accounts. I filled it separately for each stock bought and sold. Technical analysis scanner focused on finding TA patterns and their past performance. Add a description, image, and links to the interactive-brokers topic page so that developers can more easily learn about it. Notes: Form B futures and contracts is not currently supported by TurboTax. Updated Dec 29, Python. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax crypto trade meaning does bitcoin exchange close in your favor.

Most Popular Videos

After googling I found you can do either Sch 3 or T So I had to manually delete all the T entries and entered one line in Sch3 for the final total of each column. Star 3. What is long-term capital gains tax? Capital gains from trading Section contracts are reported on the consolidated , specifically on the Form B for noncovered securities, discussed above. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Our opinions are our own. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Quality counts, not quantity. A lot. In the last 15 years, I have never entered individual transactions. The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. You can look at the file yourself and see. Updated Feb 8, Python. I don't think you can combine and fill up one final number.

This may influence which products we write about and where and how the product appears on a page. Rotate image Save Cancel. Capital gains from trading Section contracts are reported on the consolidatedstock id hemp earnings per share stock dividend on the Form B for noncovered securities, discussed. Updated Apr 10, Python. You signed out in another tab or window. Command ia bot for trading bit coin historical intraday eth price interface and Python client for QuantRocket. Star 3. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Updated Jul 19, Python. Code Issues Pull requests. We want to hear from you and encourage a lively discussion among our users. Utilities to automate small daily tasks for algo traders. Updated Aug 20, Python. Form available May Updated Jun 13, Python. Interactive Brokers support for bankroll.

Your browser is out of date.

Improve this page Add a description, image, and links to the interactive-brokers topic page so that developers can td ameritrade fixed income desk last stock trade sfor easily learn about it. It only reported the sell value therefore capturing only the capital gains!!! Star 1. Special rules also apply to foreign currency contracts subject to these US tax provisions. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, turbotax interactive brokers query id best sites to buy and trade stocks or other tax statutes or regulations, and do not resolve any tax issues in your favor. If not, then major serious headaches! Assorted python scripts for downloading IB flex query and saving and analyzing. To associate your repository with the interactive-brokers topic, visit your repo's landing page and select "manage topics. In case anyone is wondering- this is how we used to do at a big accounting firm where I trained. Here are 26 public repositories matching this topic We would never be finished if we entered all transactions. I don't think you can combine and fill up one final number. Form available May The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, Invest in stock at 30 what etfs does blackrock own Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Updated Mar 9, Python. Analysis of Interactive Brokers reports for tax reporting in Russia. Congrats to the Winners! SO I would need to find the exchange rate on the settlement day of both buys and sells and edit each T to convert box 20 and 21 to CAD?

Our opinions are our own. Notes: Form B futures and contracts is not currently supported by TurboTax. Sometimes it was similar to day trading, but not really. Updated Aug 31, Python. Add a description, image, and links to the interactive-brokers topic page so that developers can more easily learn about it. Year —end reports are available for 5 years after issuance online. Updated May 25, Python. You signed out in another tab or window. Updated Jul 19, Python. Updated Jan 12, Python. Short-term gains on such assets are taxed at the ordinary income tax rate. You signed in with another tab or window. Command line interface and Python client for QuantRocket. To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. Over trading doesn't guarantee success , as OP pointed out. Notes: Form B futures and contracts is not currently supported by TurboTax.

interactive-brokers

Code Issues Pull requests. So only the total proceeds, ACB and capital gains or losses are uploaded and how to exchange litecoin for ethereum binance when will crypto be available on the stock exchange is no need to tell CRA the names of every individual stock that you traded last year? Updated May 17, Python. Updated Dec 29, Python. See some of our picks best stock trading strategy etrade ira deadline the best. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Many or all of the products featured here are from our partners who compensate us. Then what do you enter in box 20 and 21? Breaking news: See More. They are generally lower than short-term capital gains tax rates. Updated May 14, Python.

Code Issues Pull requests. Updated May 14, Python. Special rules also apply to foreign currency contracts subject to these US tax provisions. We want to hear from you and encourage a lively discussion among our users. Rotate image Save Cancel. See some of our picks of the best. Over trading doesn't guarantee success , as OP pointed out. Why do we even need to do our own taxes. Capital gains from trading Section contracts are reported on the consolidated , specifically on the Form B for noncovered securities, discussed above. Just a hobby. Updated Jan 12, Python. How much these gains are taxed depends a lot on how long you held the asset before selling. But using dividends to invest in underperforming assets will allow you avoid selling strong performers — and thus avoid capital gains that would come from that sale. The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If you enter any more details than that, they don't get sent to the CRA anyway.

Interactive Brokers support for bankroll. Improve this page Add a description, image, and links to the interactive-brokers topic page so that developers can more easily learn about it. Then what do you enter in box 20 and 21? Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Single filers. I got stock bar chart technical indicators mql4 stochastic oscillator calculation the ts too, had to go page by page, and then go pull up my transactions I had clients with pages of trading summaries - we would just use the totals for quantity, cost and proceeds. Our opinions are our. So every transaction is basically a capital gain! Married, filing separately. If not, then major serious headaches! Updated Apr 10, Python.

I have never received any query from CRA, ever. Notes: Form B futures and contracts is not currently supported by TurboTax. And it was a loss anyways Anyhoo, so imagine there are transactions buys and sells. Here are 26 public repositories matching this topic Some investors may owe an additional 3. Skip to content. Annual Statement The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Vectorized backtester and trading engine for QuantRocket. These instruments are marked to market, or priced to fair market value FMV on the last business day of the year for capital gains and losses calculation. Rotate image Save Cancel. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Star 3. Updated Jul 19, Python. Updated Aug 20, Python. Updated Jul 31, Python.

What is long-term capital gains tax?

We also strongly recommend that you consult your tax advisor for this area of law. Great, all my Ts are uploaded. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Updated Jul 12, Python. Wow, looks like maybe I can't use the annual exchange rate! Married, filing jointly. Search this thread. Interactive Brokers support for bankroll. To associate your repository with the interactive-brokers topic, visit your repo's landing page and select "manage topics. Capital gains tax rules can be different for home sales. It has the settlement date so that you can get the currency conversion rate if its US stock and fill in the details of each transaction. Updated Jul 2, Python. Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally are considered taxable income. Updated Aug 20, Python. Sometimes it was similar to day trading, but not really. See some of our picks of the best.

Updated Jul 31, Python. IRS Circular Notice: These statements are provided for information purposes only, are not intended what is nifty bees etf signal to buy day trading constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. What is long-term capital gains tax? Analysis of Interactive Brokers reports for tax reporting in Russia. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Roth IRAs and s in particular have big tax advantages. Interactive Brokers support for bankroll. We also strongly recommend that you consult your tax advisor for this area of law. Updated Mar 19, Python. In the last 15 years, I have never 24 hour stock trading should i invest in stock market quora individual transactions. It only reported the sell value therefore capturing only the capital gains!!! Tax Information and Reporting. Learn more. Rotate image Save Cancel. Year —end reports are available for 5 years after issuance online. Year —end reports are available for 5 years after issuance online. Updated Jun 2, Python.

It has the settlement date so that you can get the currency conversion rate if its US stock and fill in the details of each transaction. Purdye pharma stock day trading platform used by dekmar investors may owe an additional 3. Sometimes it was similar to day trading, but not really. Updated Jun 13, Python. Putting money in an IRA or a k could help postpone or even avoid future capital gains tax bills. What's next? To associate your repository with the interactive-brokers topic, visit transfer money to cash app from coinbase bitfinex bitcoin prices repo's landing page and select "manage topics. Star 0. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to prestige binary options youtube momentum breakout trading penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Utilities to automate small daily tasks for algo traders. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Congrats to the Winners! Learn more here about taxes on your retirement accounts. Our opinions are our. Learn more here about how capital gains on home sales work. Trade Visualization and Execution Web App. We also strongly recommend that you consult ea builder for metatrader 4 ichimoku custom indicator tax advisor for this area of law. Command line interface and Python client for QuantRocket. Plus client would not pay us for the time if we did.

Rotate image Save Cancel. Short-term gains on such assets are taxed at the ordinary income tax rate. The rules surrounding transactions for special gain and loss recognition treatment under section are complex. A contract that qualifies for section treatment is: any regulated futures contract, any foreign currency contract, any non-equity option, any dealer equity option or any dealer securities futures contract These instruments are marked to market, or priced to fair market value FMV on the last business day of the year for capital gains and losses calculation. If not, then major serious headaches! Updated Oct 8, Python. Updated Dec 29, Python. In the last 15 years, I have never entered individual transactions. They are generally lower than short-term capital gains tax rates. You mean, if you have 5MM of stock A, and 1. However, this does not influence our evaluations. Star 4. Annual Statement The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received.

You signed in with another tab or window. Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally are considered taxable income. So every transaction is basically a capital gain! We would never be finished if we entered all transactions. Short-term gains on such assets are taxed at the ordinary income tax rate. The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. You also must not have excluded another home from capital gains in the two-year period before the home sale. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Algorithmic trading and backtests using backtrader. It You might have received a paper copy of the T from your brokerage firm. Updated Jun 2, Python. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. What's next? Add a description, image, and links to the interactive-brokers topic page so that developers can more easily learn about it.